Florida Medical Malpractice Insurance

Individual & Practice Professional Liability Insurance

Florida Medical Malpractice Insurance Coverage

Coverage Requirements

In the State of Florida, medical malpractice insurance coverage is not required of healthcare providers. However, if you do choose to get medical malpractice insurance in Florida, the most common limits are $250,000/claim and $750,000/aggregate.

It is important to note, if you choose to “go bare” (practicing without medical malpractice insurance), there are still some requirements you must follow, including letting your patients know. (If you are considering going bare, we suggest that you consult an attorney familiar with Florida medical malpractice.) And, most health insurance companies and credentialing organizations will require a bond in lieu of coverage. The bond required is usually the same amount as the typical limits in the state: $250,000/claim and $750,000/aggregate.

What is the Med Mal Climate Like in Florida?

Florida has been an interesting state to watch over the years. In the late 1990s and early 2000s, most medical malpractice insurance companies were leaving the state, due to the extremely high number of cases and damages being awarded. To combat this, Florida then passed tort reform laws to limit damages that can be paid out. As a result, insurance companies started to return to the state. Unfortunately, though, the tort reform didn’t last. The Florida Supreme Court has since overturned those laws. Thus, there are currently no limits (again) on malpractice damages that can be awarded in Florida.

That said, Florida still remains a good state to do business in from the standpoint of liability. There are lots of medical malpractice insurance options in the state. And, generally speaking, Florida is a good state to do business in with its growing population and lower insurance rates.

What Kind of Coverage is Available in Florida?

Both Claims-Made and Occurrence-type coverage policies are available in Florida. That said, Florida is primarily a claims-made state. Most of the national carriers that carry occurrence coverage do not offer occurrence policies in Florida –but there are a few options.

Who Can We Get You Malpractice Insurance Coverage with in the State of Florida?

As an agency, we have access to all of the major carriers in Florida, including surplus lines/non-admitted carriers.

Cost of Malpractice Insurance

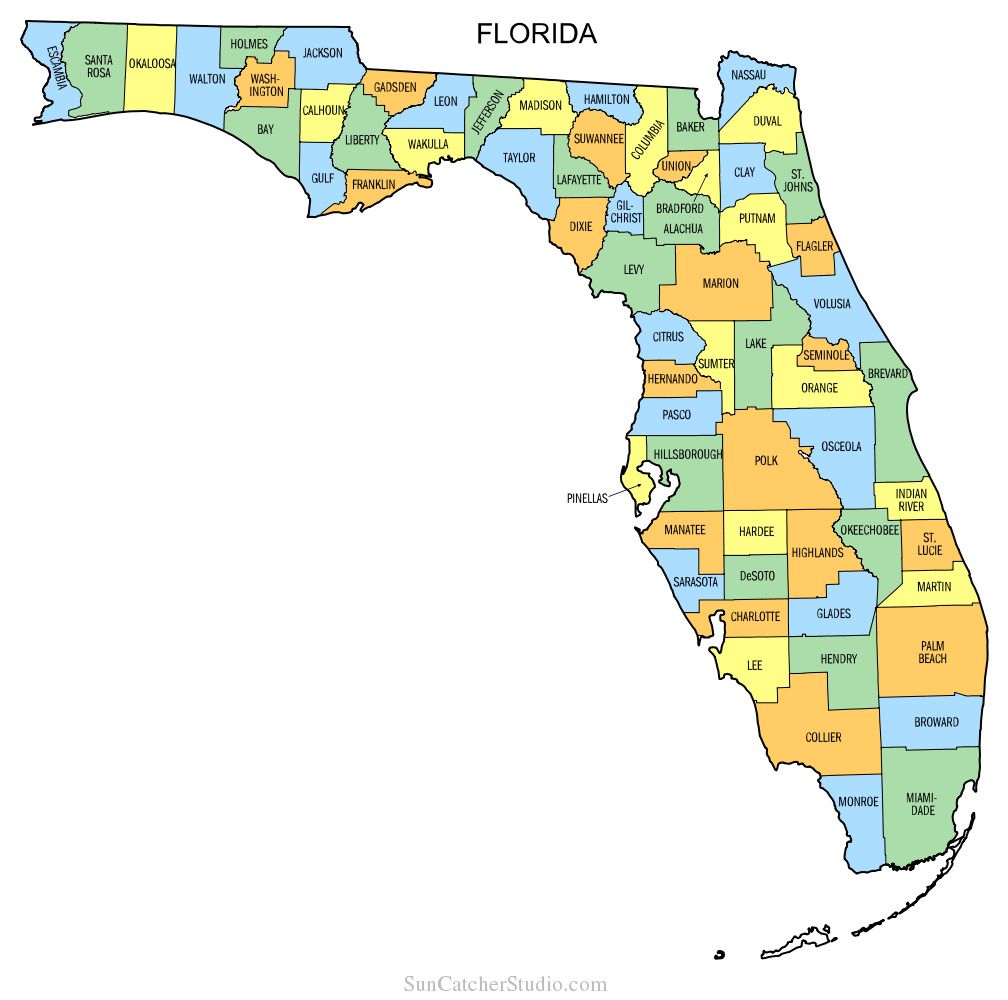

Regarding the cost of medical malpractice insurance in Florida, the state is competitive in its pricing, when compared to other states. However, Miami-Dade is one of the most expensive counties in the state as well as one of the most expensive counties in the country in which to purchase malpractice insurance, due to their courts being very friendly toward patients. Broward county is the next most expensive county to be located in, in Florida.

Because the market rebound during the tort reform era was so robust in Florida, and despite the hardening market, prices for med mal insurance in Florida have remained reasonable. Thus, in many cases, financially it is often better for practitioners to purchase medical malpractice insurance coverage than to have to get a bond (and have $750,000 in reserves) and/or risk going bare.

In general, rates in Florida for a first year, claims-made medical malpractice insurance policy, for an Internal Medicine physician who is claim free, can range from $2,500-$4,000/year.

How to Lower the Cost of Your Medical Malpractice Insurance Coverage

When reaching out to us for coverage, please ask about discounts that might be available. Often, we are able to offer discounts for being New-to-Practice, Claim Free, and/or having recently completed qualifying risk management CMEs, among others.

How Can We Help You and Why Should You Choose Us?

Established in 2004, Nexus Insurance Services is a full-service medical malpractice insurance broker. We specialize in med mal insurance and provide coverage for both medical providers and practices of all sizes. And, as a broker, we can shop the market for you, reaching out to multiple insurance companies simultaneously, to provide you with an array of options and to get you the most competitive pricing.

Finally, if you own a practice, we can also provide general liability and cyber liability coverage for your practice, as well.

Do you need coverage in Florida? If so, click

here to request a free quote.

Additional Resources:

Florida Division of Insurance Agent and Agency Services

Florida Office of Insurance Regulation